salt tax cap news

Congressional Democrats are negotiating changes to the 10000 cap on the federal deduction for state and local taxes known as SALT. The Washington-based Institute on Taxation and Economic Policy recently estimated the SALT cap will cost US.

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People

Financial Planning Tax Planning.

. A new bill seeks to repeal the 10000 cap on state and local tax deductions. Still the elimination of the 10000 cap stunned Jersey residents when it emerged from the fine print of President Donald Trumps sweeping tax cuts in December 2017. December 12 2021 930 AM 4 min read.

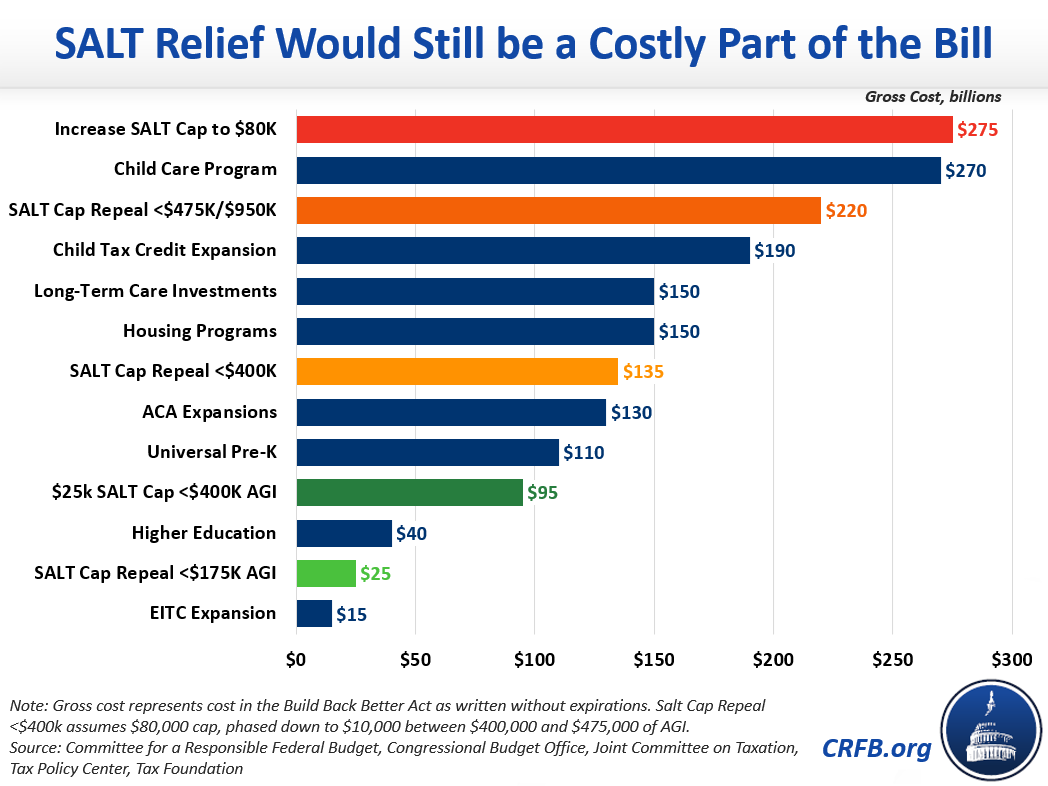

The current SALT cap is set to expire after 2025. The Biden Administrations Build Back Better Act proposes raising the cap currently set at 10 000 to 80 000. Fox News Shannon Bream.

This Bill Could Give You a 60000 Tax Deduction. Prior to the Tax Cuts and Jobs Act TCJA you could deduct the full amount with no restrictions. The TCJA reduced the corporate tax rate from.

The Courts order list included a. Pass-through business owners in a growing number of states may take advantage of entity-level state tax elections as a measure of relief from the 10000 federal deduction limit for state and local taxes the SALT cap which was introduced under the 2017 Tax Cuts and Jobs Act or TCJA. Previously they could deduct the full amount.

Tax experts say removing the cap. But what is the SALT cap. Manchin Spurns SALT-Cap Expansion in Economic Agenda Bill.

December 12 2021 930 AM 4 min read. Supreme Court declined Monday to review an appellate case that upheld the 10000 limit on the amount of state and local taxes SALT that can be claimed as a deduction on individual federal income tax returns. President Donald Trumps 2017 tax reform capped the SALT deduction at 10000.

Taxpayers nearly 101 billion more this. The deduction was previously one of the largest federal tax expenditures and cost 101 billion in fiscal year 2017. Americans who rely on the state and local tax SALT deduction at.

Joe Manchin D-WVa halted the plan in the Senate. 12There has been a lot of discussion amongst government leaders about the cap on state and local tax SALT deductions. The trend among states to adopt elective pass-through entity.

The deduction has a cap of 5000 if your filing status is married filing separately. Although House Democrats in November passed an 80000 SALT cap through 2030 as part of their spending package Sen. But the TCJA imposes a 10000 cap on deductions for.

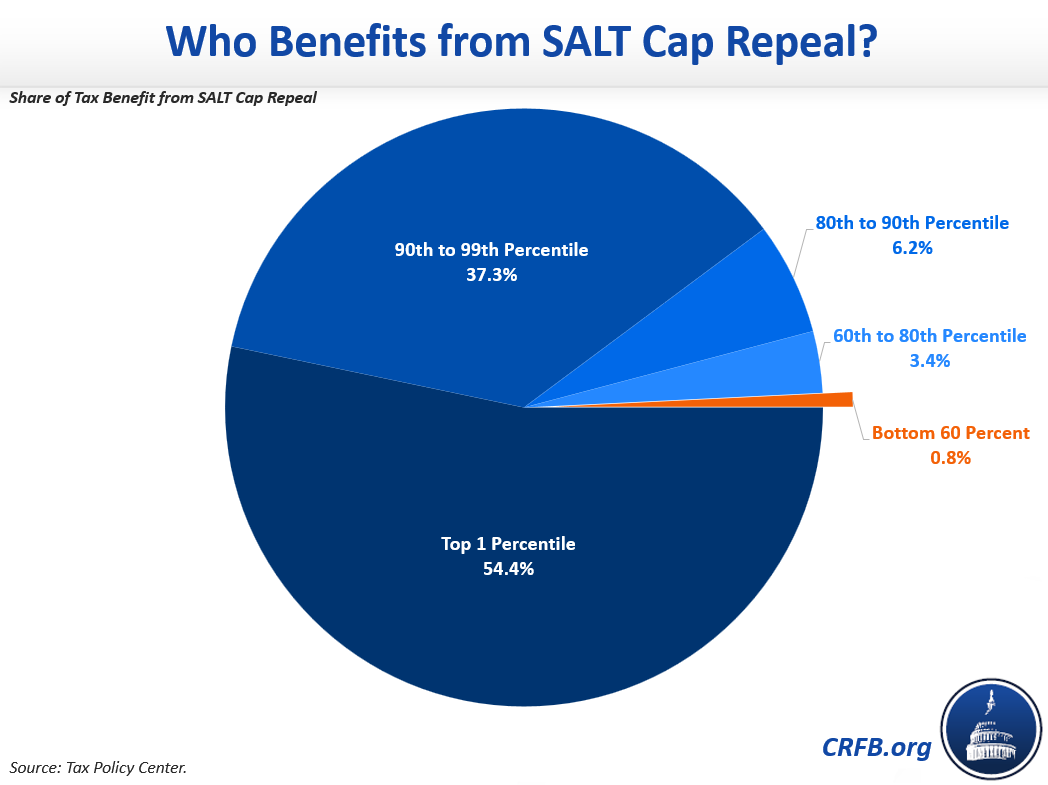

The benefit of repealing the 10000 federal cap on the state and local tax SALT. Missing SALT tax break complicates path for. Republicans have criticized the bill saying it would disproportionately benefit ultra-wealthy Americans in blue states.

For married couples filing separately its a 5000 cap. However nearly 20 states now offer a workaround. The Supreme Court will not revive an attempt by New York and three other states to overturn the Trump-era 10000 cap on state and local tax deductions known as SALT.

The courts denial of. Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation. The latest SALT plan would remove the current 10000 cap part of the 2017 tax overhaul entirely for those making less than 400000 a year.

Republicans created the 10000 cap on SALT deductions as a means to offset the cost of their other tax cuts in the 2017 Tax Cuts and Jobs Act TCJA. This cap remains unchanged for your 2021 taxes and it will remain the same in 2022 if Congress doesnt remove the cap in its spending bill. Restoring it in full is a key priority for Democratic lawmakers.

That figure dropped to 21 billion in 2020. 2018 analysis showed 752000 Californians earning less than 250000 a year paid an additional 1 billion in federal taxes thanks to the SALT cap. By Laura Davison and Erik Wasson News July 28 2022 at 0740 AM Share Print.

The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act a tax reform passed in 2017. Finally repealing the cap would be expensive for the federal government. Democrats have forged a compromise to.

The SALT state and local tax cap doesnt allow people to deduct more than 10000 of specific state and local taxes from their federal income taxes through 2025. Before the creation of a cap on this deduction 91 of the benefit of the SALT deduction was claimed by taxpayers with incomes of more than 100000 and was concentrated in six states. On Monday the Supreme Court refused to review a challenge brought against a tax deduction limit which was implemented by the Trump administration and has continued through the Biden administration.

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Salt Deduction Relief May Be In Peril As Build Back Better Stalls

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 Bloomberg

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Salt Deduction Resources Committee For A Responsible Federal Budget

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Gaming The Salt Cap May Be Congress S Worst Tax Idea Of The Year